Mortgage Services

From pre-approvals to investment properties, I'm here to Help.

Partnering With a Mortgage Agent Level 2 For Success

A Mortgage Agent Level 2 does more than find the best interest rate. I'll guide you through the process, educate you on home finance and economic trends, address your concerns, and support you long after the transaction. Since a mortgage is a long-term commitment, your choice in a mortgage professional should be too.

Here's what I can help with and more:

Pre-Approvals

Purchase Applications

Refinance & Renewals

Interest Rate Holds

First-Time Home Buyer Guidance

Investment Property Financing

Debts Consolidation

Renovation Mortgages

Home Equity Line of Credits

Self-Employed Mortgages

Reverse Mortgages

Bruised Credit Programs

Private Financing

Separation Mortgages

Bridge Loans

Ongoing Support & More

Get Pre-Approved in 30 Seconds Or Less!

Complete Your Purchase Application Now!

Explore Your Renewal or Refinance Options Today!

Frequently Asked Questions

What is a pre-qualification?

A pre-qualification is when you provide generalized information to a lender or online calculator, without the information being confirmed, and receive an estimated max purchase price.

What is a pre-approval?

A pre-approval is when a qualified mortgage professional reviews the information provided, such as your mortgage application, income & down payment documents, along with verifying your credit bureau to provide you with a more accurate max purchase price.

What is an approval?

After you have an accepted offer to purchase your dream home, your Mortgage Broker will submit your information to a lender. Once the lender reviews & confirms all the information provided, they will provide you with a full approval.

How much do I need for a down payment?

If you're buying an owner-occupied property, you may be eligible to put as little as 5% down. Keep in mind that just because the minimum down payment is 5%, you still need to qualify for the total mortgage amount (based on your income & debts).

Many people don't realize that the rules change for a purchase price above $500,000. In this case, you will require 5% on the 1st $500K and 10% on the remainder (up to $1M). If you're purchasing a home for over $1M you will require a minimum of 20% down.

If you're purchasing a rental property you will require a minimum of 20% down.

What if I don't qualify for the home I want?

This is where your mortgage professional can help provide you options, such as adding a co-signer, increasing your down payment and/or paying off debts. A Mortgage Broker/Agent has access to multiple lenders, so even if don't fit certain lender guidelines, they can shop around to see if another lender may approve your application.

What is a co-signer?

A co-signer is typically added to your application when you don't qualify for a home on your own. We add their income and debts to your application, to see if it increases your overall approval numbers. When someone cosigns for you, they will be added to the title of the mortgage and mortgage documents. This new mortgage debt will also appear on their credit bureau, which can affect their future credit score & loan affordability.

What is a guarantor?

A guarantor is typically added to your mortgage application when you have poor credit repayment or little to no credit history. Sometimes lenders will request a guarantor when your application is slightly weaker than they would want to see to approve you on your own. In most cases, the mortgage will not show on the guarantor's credit bureau, but this can vary from lender to lender.

What is Default Insurance?

Most people refer to this as CMHC fees. That said, there are actually 3 companies that provide this insurance to Canadians, CMHC, Sagen and Canada Guaranty.

This insurance is mandatory for those who purchase a home with less than 20% down. Default insurance is then added to your mortgage and increases your overall mortgage amount.

Even though this is an added cost to buying a home, it's still a great way to get into the market when you don't have a 20% down payment. Default insurance is meant to protect your lender, in the event you stop making your mortgage payments & the lender has to foreclose on you.

We had an excellent experience working with SK as our mortgage broker. From the very beginning, he was incredibly efficient and took the time to clearly explain all the mortgage details and their implications. His advice was thoughtful and thorough, and he supported us throughout every step of the process. What truly stood out was SK availability, no matter the time of day or even on weekends, he was always there to answer our questions and offer guidance. He went above and beyond to secure the best rate on the market for us. Even though we may not have been the easiest clients, SK remained patient, professional, and supportive throughout. His dedication, responsiveness, and expertise made a stressful process feel much more manageable. We are very grateful for his help and would highly recommend him to anyone looking for a top-notch mortgage broker.

Build With SK is a Lifesaver! I honestly can’t thank SK enough. He got me out of a really bad financial commitment that I had signed and was stuck in—a situation where I owed money and felt completely trapped. Sahib stepped in, untangled the mess, and not only freed me from that obligation but also secured me a brand new mortgage at a much better rate, saving me a significant amount of money. His professionalism, knowledge, and calm under pressure were exactly what I needed. He handled everything with clarity and confidence, explaining each step and making sure I felt supported the entire way. What seemed impossible became completely manageable thanks to him. If you’re dealing with a complicated situation or just want someone who will fight for the best outcome for you, look no further. SK is truly exceptional at what he does—and I’m beyond grateful for his help.

We are beyond grateful to have had SK as our mortgage broker. From the very beginning of our home-buying journey, he showed an exceptional level of professionalism, kindness, and dedication that made all the difference in what can often be a stressful process. SK took the time to truly understand our financial goals and walked us through every step from exploring the best mortgage options, to securing a great rate, to ensuring a smooth closing. What stood out most was his patience, responsiveness, and genuine care. He answered every question (no matter how small), explained the process in clear and simple terms, and never made us feel rushed or pressured. When a few unexpected hurdles came up, SK handled them calmly and efficiently, always providing thoughtful guidance and practical solutions. It’s rare to meet someone who is not only incredibly knowledgeable but also so kind and supportive. He was a steady hand through the entire experience and made sure we always felt informed and confident in our decisions. Thanks to SK, we are now proud and happy homeowners. We can’t recommend him highly enough to anyone looking for a mortgage broker who is trustworthy, experienced, and genuinely committed to helping you succeed. Thank you SK for everything.

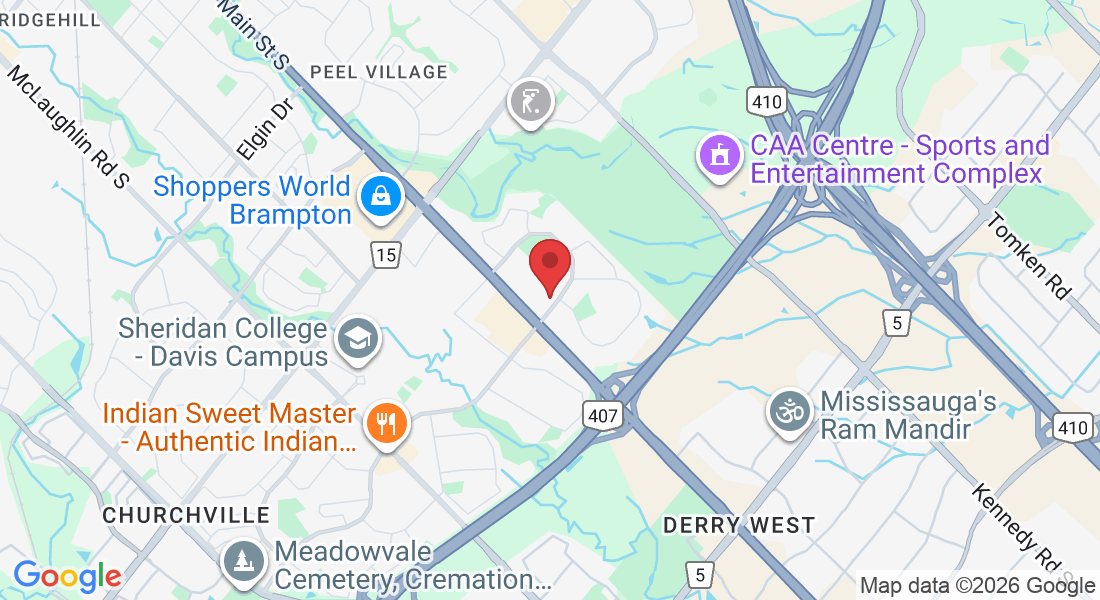

Get In Touch

Operation Hours

Mon - Fri:10:30 am - 6:00 pm

Saturday:12:00 pm - 5:00 pm

Sun : CLOSED

Phone Number: